Icici Bank Fixed Deposit Rates

ICICI new FD rates: Many banks have been lowering their deposit rates citing surplus liquidity. Now, ICICI Bank, a private sector lender has revised its fixed deposit rates, applicable form today.

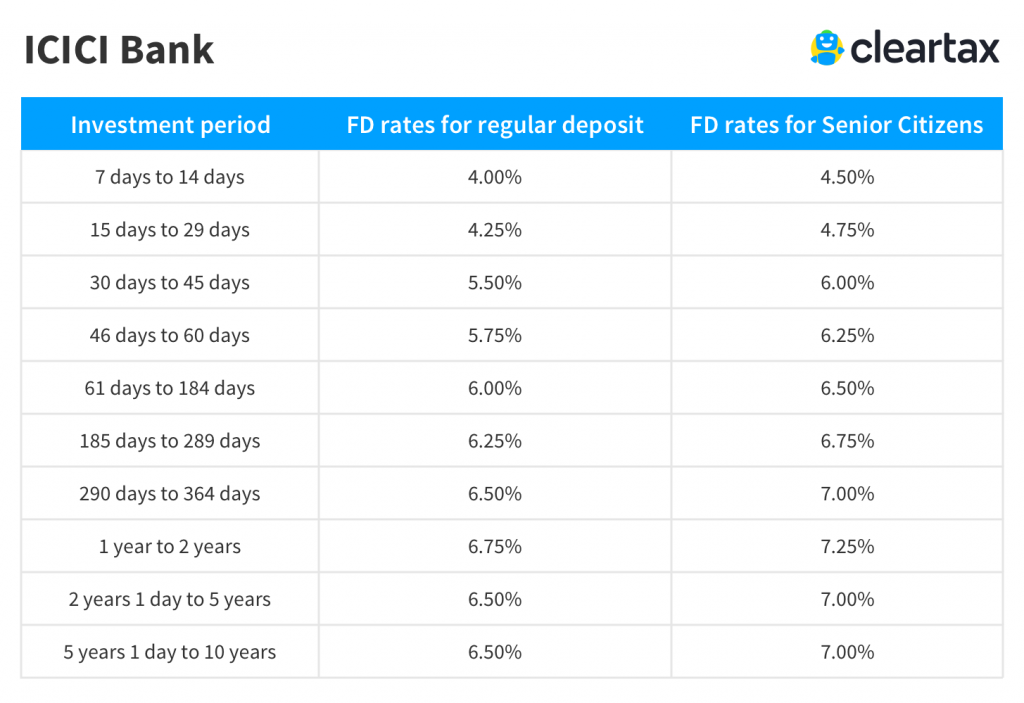

Now, ICICI Bank, a private sector lender has revised its fixed deposit rates, applicable form today. Also, Earlier this month, on June 4, ICICI Bank had cut interest rates on savings account deposits of less than ₹ 50 lakh to 3%, a reduction of by 25 bps as against 3.25% earlier. New Fixed Deposit Rates from ICICI Bank. The fixed deposit interest rates of ICICI Bank have been revised. The private sector lender offers fixed deposits with maturity periods ranging from 7 days to 10 years. Senior citizens will continue to get 50 bps higher interest rates than others. The last revision was done by the bank on 20 September 2019.

Also, Earlier this month, on June 4, ICICI Bank had cut interest rates on savings account deposits of less than ₹50 lakh to 3%, a reduction of by 25 bps as against 3.25% earlier. Likewise, for deposits of ₹50 lakh and above, the account holders will earn an interest of 3.50%, down from 3.75%.

Currently, banks have ample liquidity and comparatively less demand for loans due to the lockdown. This has put pressure on deposit rates.

Starting from an interest rate of 2.75% on FD deposits between 7 days to 14 days, ICICI Bank is currently offering 5.15% on deposits between 1 year to 389 days. Customers get 5.35% on FDs with maturity between 18 months days and 2 years 5.35% which rises to 5.50% on deposits of over three years.

- ICICI Bank has raised its interest rates on fixed deposits between 15 basis points (0.15%) to 25 basis points (0.25%) on selected term deposits. Also the bank announced in a statement, ICICI Bank staff will get an additional 1% interest on domestic term deposits below Rs. The revised FD rates will apply for both General and Senior.

- The ICICI Bank FD rates for fixed deposits more than 5 years is 0.30% extra per annum. The senior citizen residents of India will get additional ICICI Bank FD rates of 0.30% for a specific period above than the.

Senior citizens get an additional interest rate of 50 basis points across all maturities.

ICICI Bank FD rates on deposits below ₹2 crores (general public):

7 days to 14 days 2.75%

15 days to 29 days 3.00%

30 days to 45 days 3.25%

46 days to 60 days 3.50%

61 days to 90 days 3.50%

91 days to 120 days 4.10%

121 days to 184 days 4.10%

185 days to 210 days 4.50%

211 days to 270 days 4.50%

271 days to 289 days 4.50%

290 days to less than 1 year 4.75%

1 year to 389 days 5.15%

390 days to < 18 months 5.15%

18 months days to 2 years 5.35%

2 years 1 day to 3 years 5.35%

3 years 1 day to 5 years 5.50%

Icici Bank Fd

5 years 1 day to 10 years 5.50%

5 Years (80C FD) – Max to ₹1.50 lakh 5.50%

ICICI Bank FD rates on deposits below ₹2 crores (senior citizens):

7 days to 14 days 3.25%

15 days to 29 days 3.50%

30 days to 45 days 3.75%

46 days to 60 days 4%

61 days to 90 days 4%

91 days to 120 days 4.6%

121 days to 184 days 4.6%

185 days to 210 days 5%

211 days to 270 days 5%

271 days to 289 days 5%

290 days to less than 1 year 5.25%

1 year to 389 days 5.65%

390 days to < 18 months 5.65%

18 months days to 2 years 5.85%

2 years 1 day to 3 years 5.85%

3 years 1 day to 5 years 6%

5 years 1 day to 10 years 6.3% (ICICI Bank Golden Years FD)

Fixed Deposit Rates In India

5 Years (80C FD) – Max to ₹1.50 lakh 5.50%