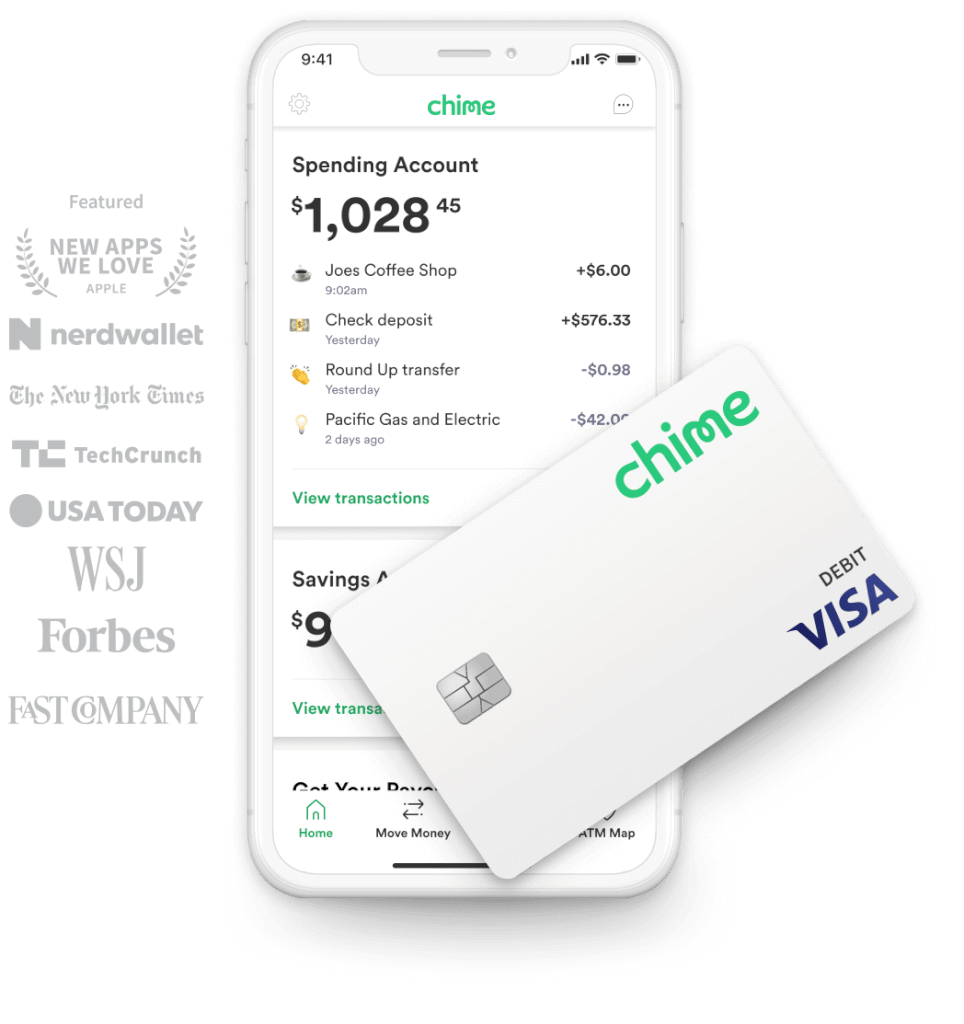

Chime Mobile Check Deposit

Fee-free overdraft up to $100.¹ Get paid up to 2 days early with direct deposit.² Grow your savings.

How long does it take for Chime mobile check deposit? Chime usually deposits the check amount in your account as soon as it clears the process. It mostly depends on the originating bank as Chime bank won’t hold any type of deposits. With the early direct deposit feature, your direct deposit will be posted to your Chime Spending Account as soon as it is received from your employer or payer. If you have questions about the timing of your. Banking Services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa ® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. ¹ Chime SpotMe is an optional, no fee service that requires $500 in qualifying direct deposits to the Chime Spending Account each month. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases initially, but may be later eligible for a higher limit of up to $100 or more based on member's Chime. Mobile check deposit allows you to deposit checks from anywhere. Send money instantly online to your friends and family Send money instantly to friends using our mobile.

Learn how we collect and use your information by visiting our Privacy Policy›

The Bancorp Bank or Stride Bank, N.A.; Members FDIC

Overdraft fee-free with SpotMe

We’ll spot you up to $100 on debit card purchases with no overdraft fees. Eligibility requirements apply.¹

Get paid early

Set up direct deposit and get your paycheck up to 2 days earlier than some of your co-workers!²

Say goodbye to hidden fees³

No overdraft. No minimum balance. No monthly fees. No foreign transaction fees. 38,000+ fee-free MoneyPass® and Visa Plus Alliance ATMs. Out-of-network fees apply.

Make your money grow fast

0.50% Annual Percentage Yield (APY)⁴. Set money aside with Automatic Savings features. And never pay a fee on your Savings Account.

Stay in control with alerts

You’re always in-the-know with daily balance notifications and transaction alerts

Security & support you can trust

Serious security

Chime uses secure processes to protect your information and help prevent unauthorized use

Chime Mobile Check Deposit Not Working

Privacy and protection

Chime Mobile Check Deposit

Your deposits are FDIC insured up to $250,000 through The Bancorp Bank or Stride Bank N.A.; Members FDIC

Friendly support

Chime Mobile Check Deposit Instructions

Have questions? Send a message to our Member Services team in the app or check out the Help Center.

Deposit Cash Chime

Get started

Chime Mobile Check Deposit How Long

Applying for an account is free and takes less than 2 minutes.

It won’t affect your credit score!

Learn how we collect and use your information by visiting our Privacy Policy›