Chase Direct Deposit

'Chase Private Client' is the brand name for a banking and investment product and service offering. Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Make a Mobile Deposit. Making a mobile deposit is another fast way to get your check to clear. Most major banks, including Chase, Wells Fargo, Bank of America and Capital One, offer apps that enable you to take a picture of both sides of your check, enter relevant information, and send it to the bank. Funds from mobile check deposits are often. Your direct deposit needs to be an electronic deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the government. Person to Person payments (such as Chase QuickPay ® with Zelle ®) are not considered a direct deposit. After you have completed all the above requirements, we'll deposit the bonus in your new account within 15 days.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Make at least one qualifying Direct Deposit of $250 or more. Learn about qualifying direct deposits. Maintain a minimum daily balance of $1,500 or more. Students under age 24 are eligible for waiver of this fee while enrolled in high school, college or a vocational program.

Set up direct deposit

- Add money

- Checkbook orders

- Routing and account number

- Direct deposit

- View checks

- Overdraft Services

/chase_inv-9aaa00e58bc24145bddd678b46bba472.png)

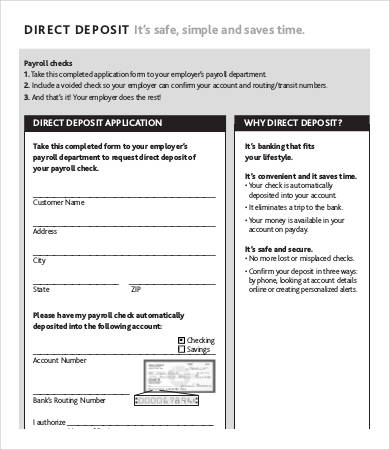

The fastest, safest way to deposit your paycheck

You can get a pre-filled direct deposit form or complete one yourself

Get your personalized pre-filled direct deposit form

- Sign in to chase.com or the Chase Mobile® app

- Choose the checking account you want to receive your direct deposit

- Navigate to Account Services by scrolling up in the mobile app or in the drop down menu on chase.com

- Click or tap on Setup direct deposit form

- We've pre-filled your direct deposit form to save you time

- Download, print or email the form

Complete a direct deposit form yourself:

- Download the form (PDF)

- Locate your 9-digit routing and account numbers - here's how to find them

- Fill in your other personal information

- Give the completed form to your employer

Common questions answered

What if I have U.S. government benefit income such as Social Security or military pay?

expandGo to fiscal.treasury.gov/GoDirect to enroll.

How do I set up direct deposit?

expand- Complete the direct deposit form.

- Deliver the form and a voided check to your company’s payroll department.

- If you’re eligible, your employer will deposit your paycheck directly into your account.

- Confirm the deposit each pay cycle by signing in to Chase OnlineSM or checking your account statement.

What information do I need to provide in order to set up direct deposit?

expand- Your employer or depositor’s name and address

- Your Employee ID or account number with depositor

- Your account number

- Your routing/ABA number

How quickly does direct deposit take effect?

expandChase Direct Deposit Coupon

Direct deposit usually takes up to two pay cycles to kick in. However, it’s different for each employer. Please check directly with your employer for specific timing.