Bank Of America Check Deposit Policy

Learn the procedure to follow when depositing mobile checks at Bank of America. This article will also include check depositing limits and the time taken to process mobile check deposits. If you also wish to know how to cancel mobile check deposits, continue reading this article.

- Bank Of America Deposit Limit

- Bank Of America Mobile Check Deposit Policy

- Bank Of America Check Deposit Policy 2020

- In the app, you can deposit a paper check, using a photo image, and get confirmation immediately that your deposit has been received. Go to our ATM and Financial Center locator to find nearby ATMs that accept deposits.

- Basically, when you deposit a check written to multiple payees, all payees must endorse the checks. Furthermore, all payees must go with you to your bank and present a government-issued ID.

Contents

Deposits in checking accounts, savings accounts, money market savings accounts and Certificates of Deposit (CDs) are insured up to $250,000 per depositor, per insured bank, for each account ownership category under the FDIC's general deposit insurance rules.

- How to deposit a check online at Bank of America

- Mobile check deposit Bank of America FAQs

How to deposit a check online at Bank of America

The Bank of America is one of the most accepted and used banks in the USA. Just like the other financial institutions, this bank has also attained a great deal and moved its services into the digital world.

Now you can deposit your check online from your destination; it can be at home, school, or workstations, without physically visiting the bank or its ATMs.

The process for depositing your check at this bank through the online method is indeed easier. Just follow the following few steps and you will be done in less than 30 minutes.

Step 1: Confirm that you have a strong internet connection

This is an important step. With strong internet connectivity, you are likely to spend less time depositing your check online.

Kindly, if you find that you find you have slow internet connections, use another option of depositing your check such as visiting the bank or move to a nearby cyber for strong internet connection.

Step 2: Confirm that your check is not fake

Confirmation of the genuineness of your check is the second most important step. It lowers the possibility of your check being rejected.

Step 3: Download the Bank of America official application

The app is available online at Google Play Store. Just download it or if you have it, go to the next step.

Step 4: Sign in to access your checking account or savings account

In case you find it difficult logging in, you can request for help from the Bank of America customer care team.

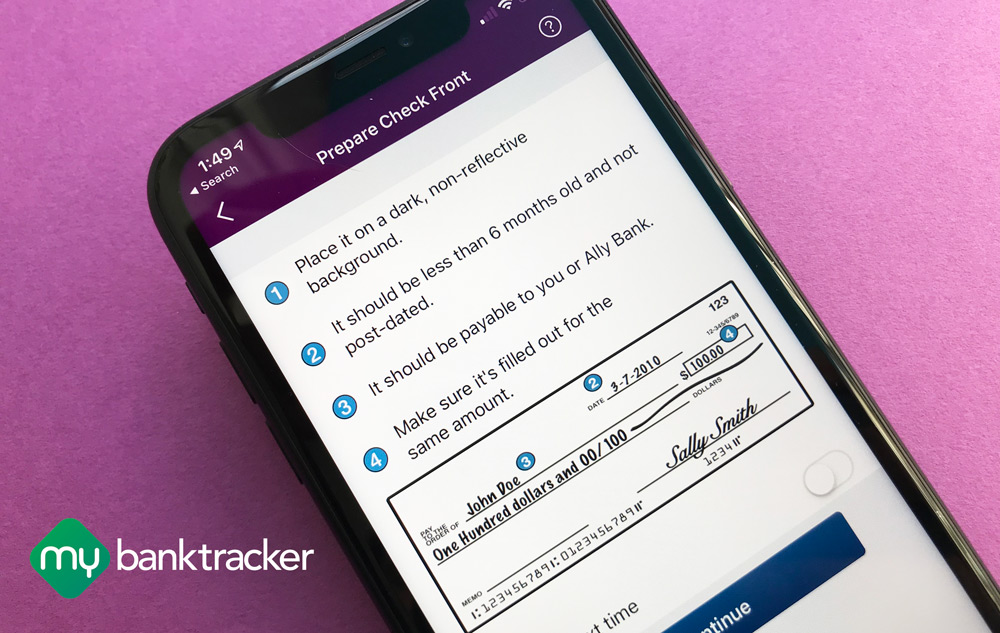

Step 5: Take a picture of your check

When taking the picture, make sure that you capture all the important details such as the amount and endorsement area.

Step 6: Upload your check

To upload your check is easier because there are steps and guidelines throughout the app, which are meant to guide you. Once you have uploaded the check, ensure the details you have entered are correct and submit your check for processing.

Step 7: Completion of depositing

You will receive a notification, once you are done. If it’s unsuccessful, you are requested to try again after rectifying the issue that could have led to the rejection of your check.

How long does Mobile check at BoA take?

Depositing a check through the BoA app usually takes twenty to thirty minutes. After this period, you will receive notification that your check has been accepted or not.

If it has been accepted, you are likely to see your money in your account after a maximum of fifteen days. The period depends on the number of clients who are using the application.

BoA mobile check deposit time

If you have a strong internet connection, you are likely to spend less than 20 minutes to have your depositing process done. However, if your internet is slow, you may take a little bit longer.

BoA Mobile check deposit Limit

The mobile check deposit feature of this bank has some deposit limits, depending on the client’s time with the financial institution, and the type of your account.

Those with an account that has been active for less than 90 days are allowed to deposit 1,000 dollars a month. But, for those whose account has been operational for over three months, they can deposit up to 5,000 dollars in a single month.

Cancel Mobile Check deposit at Bank of America

Bank Of America Deposit Limit

As an esteemed client, you are given a chance to request the cancellation of your mobile check deposit. However, when requesting a cancellation, you are expected to give the reason why you are doing so.

After that, you will wait for a notification that your check deposit has been successfully canceled. For more details, kindly contact the customer care team.

Mobile check deposit Bank of America FAQs

There are several questions that individuals do ask themselves pertaining to the Bank of America. Nevertheless, the following is the most commonly asked questions that you will ever find in almost all platforms and forums.

Mobile check deposit BoA not working – what should I do?

In certain instances, you will find that the mobile checking deposit not to work. Usually, when there a massive system failure, clients are informed through their emails or texts. Again, if there is a planned maintenance program, you will be notified.

However, if you do not receive any notification and you experience a system failure, you are advised first to check your internet connection.

If the connection is strong, you should contact the customer care team to receive further instructions on what to do.

References on BoA Mobile check deposit

- Bank of America: How to use Mobile Check Deposit for Fast & Simple Deposits

- LendEDU: Can you cancel a check?

READ MORE: Banks with Mobile check deposit

Microsoft Internet Explorer 6.0 is no longer compatible with Online Banking. To ensure maximum security and the best experience, please:

- Go to the Internet Explorer, Firefox or Chrome websites and download a new browser version

- Review Online Banking system requirements, options for access, notices and disclosures

- Once you have finished, you will need to restart your computer and sign back into Online Banking

Online Banking and eCommunications System Requirements

When you first enrolled in Online Banking, you agreed to receive certain Online Banking notices, disclosures and communications ('eCommunications'). Please refer to your Online Banking enrollment documents for a list of these eCommunications. While you may be able to access Online Banking and eCommunications using other hardware and software, your personal computer needs to support the following requirements:

- An operating system, such as:

- Windows NT, 2000, ME, XP, Vista or Win 7; or

- Mac OS 10

- Access to the internet and an internet browser which supports HTML 4.0 and 128bit SSL encryption and Javascript enabled, such as:

- For Windows NT, 2000, ME, XP, Vista, or Win 7

- Microsoft Internet Explorer 7.0 and higher

- Firefox 3 and higher

- Chrome 3.0 and higher

- For Macintosh using OS 10.x

- Safari 3.0 and higher

- Firefox 3 and higher

- Chrome 4.0 and higher

- For Windows NT, 2000, ME, XP, Vista, or Win 7

Most eCommunications provided within Online Banking or at other Bank of America websites are provided either in HTML and/or PDF format. For eCommunications provided in PDF format, Adobe Acrobat Reader 6.0 or later versions is required. A free copy of Adobe Acrobat Reader may be obtained from the Adobe website at www.adobe.com.

In certain circumstances, some eCommunications may be provided by e-mail. You are responsible for providing us with a valid e-mail address to accept delivery of eCommunications.

To print or download eCommunications you must have a printer connected to your computer or sufficient hard-drive space (approximately 1 MB) to store the eCommunications.

Bank Of America Mobile Check Deposit Policy

Withdrawing Consent to eCommunications and Effect on Online Banking Access

Subject to applicable law, you have the right to withdraw your consent to receiving eCommunications by calling the appropriate toll-free customer service phone numbers listed on the Customer Service tab. You will not be charged a fee for withdrawal of your consent.

Bank Of America Check Deposit Policy 2020

If you withdraw your consent, we may stop providing you with eCommunications electronically and we may terminate your Online Banking access. Your withdrawal of consent is effective only after you have communicated your withdrawal to Bank of America by calling the appropriate customer service phone numbers and Bank of America has had a reasonable period of time to act upon your withdrawal. Your consent shall remain in force until withdrawn in the manner provided in this section.